Municipality of Guaynabo – Tax Incentives Program

On July 3, 2023, the Mayor of Guaynabo signed Ordinance No. 47, 2022-2023 Series (the “Ordinance”), to repeal Ordinance No. 4, Series 2018-2019, and to establish a Tax Incentive Program for Eligible and Qualified Eligible Business Units that are established in the Autonomous Municipality of Guaynabo (the “Municipality”) or to encourage the establishment of new businesses and industries that generate activity and economic development through capital investment and the creation of new employments in the Municipality.

What type of businesses qualify for the tax exemption grant?

The Ordinance provides that “Eligible Businesses or Units” and “Qualified Eligible Businesses or Units” (referred to as, “Exempt Units”) qualify for the tax exemption grant.

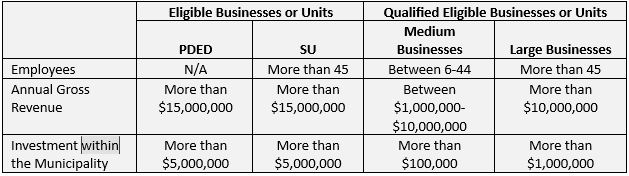

“Eligible Businesses or Units” are business or/and commercial or industrial operation, that either establishes its primary place of business within the Municipality or is already established there and engages in expanding or investing in its business within the Municipality. Additionally, it encompasses businesses that create additional employment opportunities within Guaynabo after the approval date of this Ordinance. Furthermore, the “Eligible Businesses or Units” is composed of: (1) Property Dedicated to Economic Development (“PDED”) and (2) Service Units (“SU”).

“Qualified Eligible Businesses or Units” are business and/or commercial operation, as defined by the “Eligible Businesses or Units”, that doesn’t meet the requirements of PDED or SU. The “Qualified Eligible Businesses or Units” are divided into Medium Businesses and Large Businesses.

In order to qualify for the tax exemption grant, the businesses must meet the following requirements:

About the Author

NELSON R. GONZÁLEZ PÉREZ

Nelson is a Senior Tax Associate at Alvarado Tax & Business Advisors LLC, a limited liability company dedicated to tax and business consulting services and has over five years of experience in the corporate and individual tax advisory areas. He provides corporate and individual tax services for clients in the retail, manufacturing, and service industries, among other.

Nelson has a bachelor’s degree in business administration with a major in Accounting from the University of Puerto Rico, Río Piedras Campus.

Contributor

Edwin López

Edwin is a Manager at Alvarado Tax & Business Advisors LLC, a limited liability company dedicated to tax and business consulting services, and has over six years of experience in the corporate and individual tax advisory areas.

How many years will the tax exemption grant cover the operations in the Municipality?

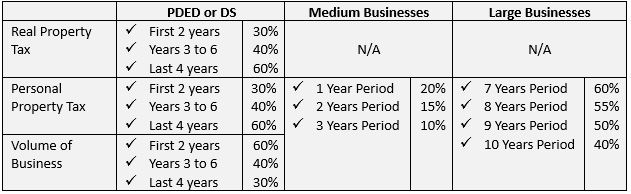

The grantee may enjoy up to ten years of tax exemption from the effective date provided in the tax exemption grant. As confirmed with the Municipality, Medium Businesses will enjoy up to three years of tax exemption, and Large Businesses will enjoy up to ten years.

What are the exemptions provided by the Ordinance?

Does the Ordinance include any additional exemptions?

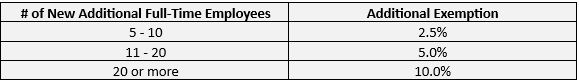

Additional exemption for affirmative job creation.

The Ordinance provides an additional exemption for Exempt Units that create new full-time employments and retain them throughout the exemption period. It is important to note that if the number of new employees is reduced or eliminated, then the additional exemption will no longer be in effect.

This additional exemption will apply to the Municipal License and will be based on a percentage corresponding to the number of new employments created.

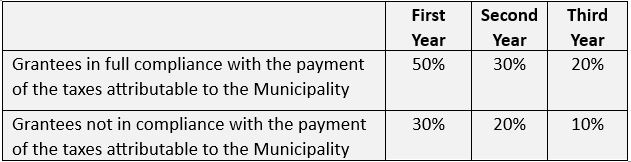

Tax exemption for businesses facing potential closure or relocation outside the Municipality

“Business facing potential closure” is referred to as a Business that can demonstrate, to the satisfaction of the Municipality, that its operations are at risk of closure or relocation outside the Municipality. Various factors will be taken into consideration while evaluating the risk of closure, including the business location, size, the number of employees it generates on average, and any other relevant considerations. This additional exemption will be subject to an analysis of reduction of assets or capital, or a significant decrease in business volume over the last five (5) years of operations.

Furthermore, the additional exemption will apply to personal and real property tax and to the municipal license. To facilitate the retention of an Eligible Unit facing the risk of closing operations or relocating outside of the Municipality, the businesses facing potential closure or relocation outside the Municipality will have the following exemptions:

Where can I complete the application for the tax exemption grant?

As confirmed with the Municipality, the application to request the tax exemption is still not available, but it should be made available within the next months.

What are the fees for requesting the tax exemption?

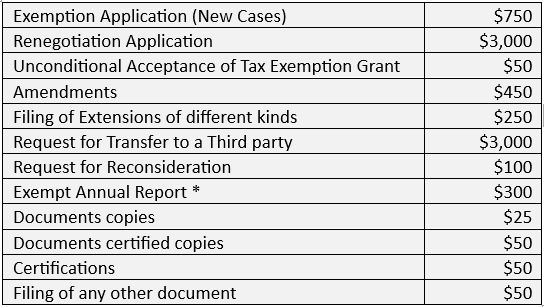

At the time of filing the Application, the Eligible Business or Qualified Eligible Business must pay the following fees, payable in cash or by certified check, or money order to the Municipality.

Every Exempt Unit is required to submit a fully completed and sworn annual report containing a comprehensive list of data demonstrating compliance with the conditions outlined in the Decree for the taxable year immediately preceding the filing date.

ATBA Comments:

This is an excellent opportunity for existing and new businesses in the Municipality to obtain municipal tax reductions. If your business is located in the Municipality and is planning an expansion of its operations or if you are interested in establishing a new business in the Municipality, our experienced tax advisors may assist in providing further information about the Ordinance and determining whether or not your business qualifies for this inventive. Our tax advisors can also assist in completing the application for the tax exemption grant, once it is available.

Should you need assistance or if you have any questions, give us a call.